Hiding Assets During a Divorce

Most divorce cases will never rise to the level of deception and cunning displayed by a Russian billionaire who bought an $88 million apartment in Central Park West in a transparent effort to hide assets. Claiming it was for his college-age daughter to use while she was attending school in New York, his wife pointed out that their daughter was not enrolled in a New York educational institution.

Even in divorce cases involving far smaller sums, and far less hubris, it can still be very challenging to obtain an equitable asset split if all the financial facts and information are not handled in an above board manner.

In-Spouse vs. Out-Spouse

In the majority of divorce cases in which there was not an equal participation in the handling of the finances, it is oftentimes the wife who is deemed to be the “out-spouse.” This means that one partner took control of all of the financial decisions, overseeing the tracking of income and paying of all expenses.

Sometimes this agreement is made openly and mutually, as in “You’re so much better than I am at math and finance, so why don’t you handle it all.” Sometimes, however, there is an implicit, unspoken collusion between both partners that one party will oversee the budget. This is often the case when one partner is business wise and finance savvy, has a dominating and controlling personality by nature, or perhaps borders on narcissistic.

Attempts to learn more about the family finances by the out-spouse may be met with accusatory questions about a lack of trust in the partner, causing them to doubt themselves and question their own intuition. They may shut down the subject out of guilt, despite the ever-present, nagging suspicion that all is not above board in the marriage. As an article in Psychology Today points out, if the out-spouse is hearing alarm bells sound over the other spouse’s ethics and integrity during the marriage, they can be sure that the potential for deception and fraud will only be heightened in the case of a divorce.

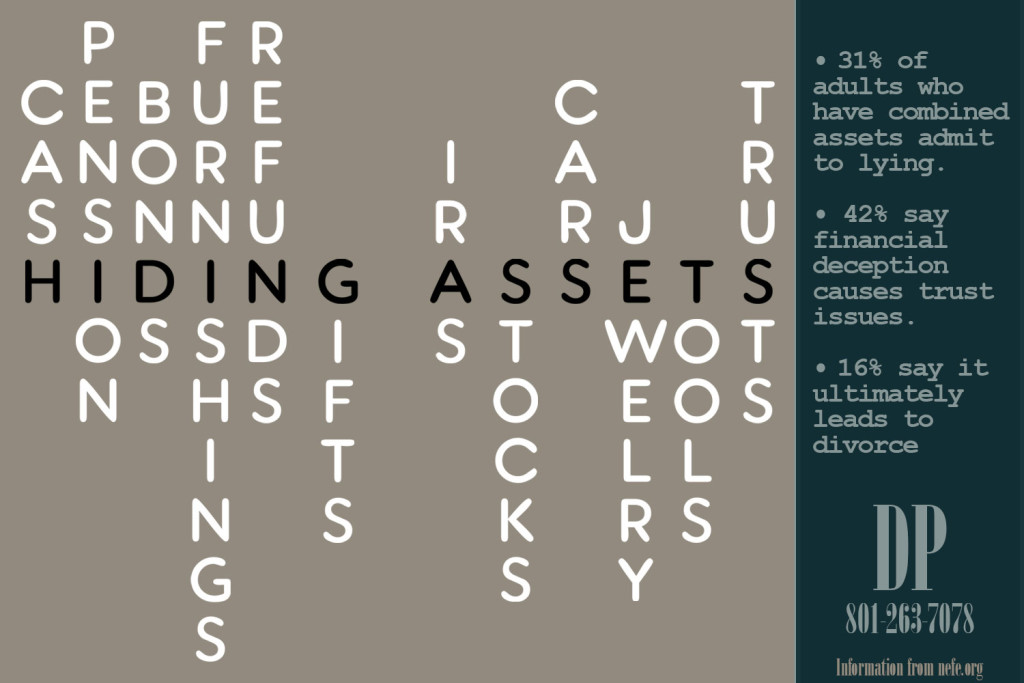

What Assets May be Hidden?

Types of hidden shared assets that may not be obvious at first include:

- Antique furnishings, original artwork, collector-level hobby equipment, pricey gun collections, and specialized tools.

- Investment in certificate bearer municipal bonds or Series EE Savings Bonds that are not registered with the IRS and therefore do not show on account statements.

- Unreported income on tax returns and financial statements.

- Money received in the form of distributions from an IRA account or deferred-compensation plan that you may not know about.

- Business owners taking money from cash receipts for personal use, known as skimming.

- Paychecks written to a fictitious employee to drain the business account, with the intention of voiding the checks post-divorce.

- Cash paid from the business to a friend or relative for services that were never performed with the knowledge that the money will be returned post-divorce.

How Assets are Hidden

- Cash may be kept in travelers’ checks.

- Alleged debt repayment to a friend or family member for a non-existent debt, or large sums of money given as cash “gifts.”

- Lavish tangible gifts and expenses paid for another intimate partner, such as rent, cars, travel, jewelry, and clothing.

- Rental real estate you may not know exists.

- Foreign accounts and hidden domestic trusts.

- A custodial account set up in the name of a child, using the child’s Social Security number.

- Collusion with an employer to delay compensation, such as bonuses or raises, until after the divorce is final.

- Tax refunds owed from previous years due to intentional over-payment in anticipation of divorce.

How to Locate Hidden Assets: The Discovery Process

If there is any doubt that a spouse will not be voluntarily forthcoming with all the financial information in your divorce, your attorney will use a legal process known as “discovery” to obtain access. This puts the weight of the legal system behind you. Your spouse can be court-ordered to cooperate under penalty of fines or other repercussions in the form of judgments.

- Request documents: Your attorney can ask your spouse to produce specific documents, such as: financial statements to all savings, checking, brokerage, and trust accounts held by one or both parties during the marriage; loan documents; credit card bills; wire transfers; profit and loss statements; royalties, copyrights, and patents; and all tax returns.

- Demand Inspections: You can petition for access to a safe deposit box, and art, gun, or wine collections. You can request that jewelry, fine collectibles, and cars be appraised.

- Interrogatories: Written questions that your spouse must answer in writing.

- Oral Deposition: Your spouse answers questions posed by your attorney in the presence of a court reporter under penalty of perjury if determined to be lying. This is a wise recourse after financial records have been procured and examined in order to direct the questioning to determine the legitimacy of the answers provided.

What are the Consequences for Lying About Assets?

Lying in a divorce and failing to disclose all assets are illegal actions and considered to be perjury. A spouse who knowingly deceives during the discovery proceedings may be charged with fraud. A large fine may be imposed, and it is possible that the deceptive spouse is ordered to pay attorney fees for the other spouse. The judge might even elect to award all of the hidden assets to the non-deceptive spouse.

Hidden Assets Attorney Salt Lake City, Utah

Attorney David Pedrazas has been helping people find hidden assets in difficult Utah divorce proceedings for over 20 years. He is committed to helping people move forward with their lives, fully informed and fully protected.

Download a PDF Version of This Infographic

Download this infographic.