In the United States, laws regulate the payment of child support from one spouse to another using civil statute; however, different states take different factors into account. While every state weights factors slightly differently, there are a few major factors that will play a role in the calculation of child support in the state of Utah. Knowing how child support is calculated will place you in a position to defend your rights if you have to discuss child support during divorce proceedings.

Breaking Down Child Support Calculation in Utah

There are a few major components that are going to play a role in the calculation of child support in the state of Utah. These include:

- Base Child Support

- Medical Care

- Expenses Related to Child Care

Utah Code Section 78B-12-301 is used to determine monthly Child Support payments. This table is used when the court takes into account the incomes of both parents prior to issuing any child support orders.

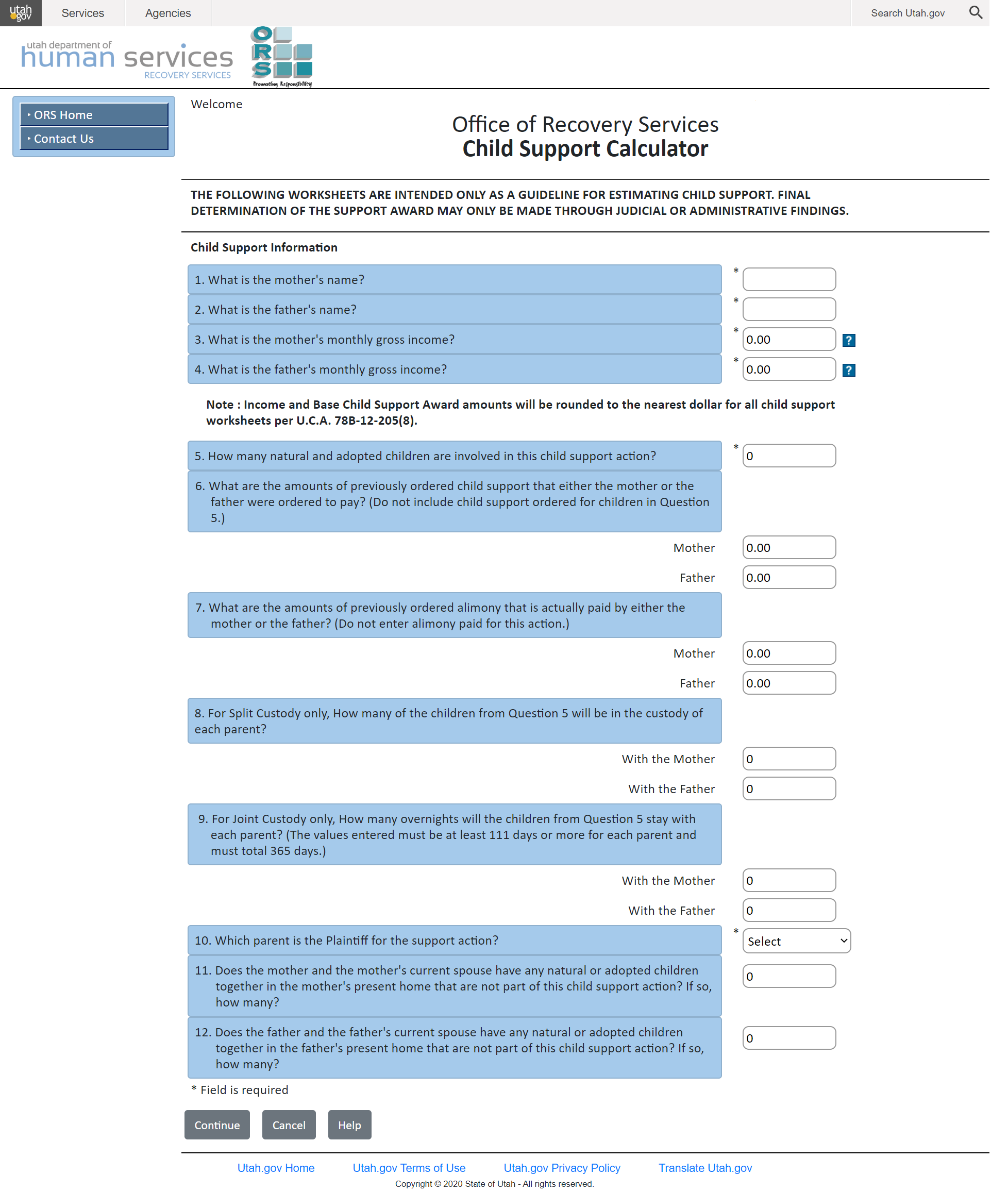

Utah Court Child Support Calculator

The Role of Medical Expenses and Child Care Expenses

As long as health insurance is available at a reasonable price, the cost of providing health insurance for any children involved is shared equally between both parents. The same is true of any non-insured medical expenses. Some of the most common expenses that might not be covered by health insurance include:

- Deductibles for visits to the emergency room

- Copays for visit to the primary care physician

- Coinsurance for any major health expenses

These are going to play a role in the calculation of child support in the state of Utah.

Furthermore, parents are also required to share any work-related childcare expenses evenly. This includes putting kids in daycare of summer camp while one or both parents are at work.

Tax Exemption for Any Dependent Children

Furthermore, a child support order could also establish which parent is allowed to claim the child as a dependent when it comes to federal or state income tax guidelines. Unless both parents are able to agree on who can claim the child as a dependent on his or her taxes, the court will issue an order awarding the exemption.

Usually, this order is based on who is going to have primary custody of the child and who is bearing the majority of the expenses when it comes to raising the minor children. The court may also not award an exemption to a parent unless that exemption will actually lead to a tax benefit. It is important to rely on an expert legal professional who understands how this process works.

How to Figure Child Support in Utah

If you are wondering, “how much I have to pay for child support” in the state of Utah, then rely on the experience of attorney David Pedrazas. From day one, David Pedrazas has been fighting to defend the rights of his clients. This includes divorce proceedings, particularly those involving child support. With more than 20 years of experience, he will fight for you as well. Call today to learn more about how he can defend your rights!

The following Utah Court Child Support Calculator is intended only as a guideline for estimating child support. The final determination of the support award may only be made through judicial or administrative findings.